Table of Contents

- Strategic Location and CBD Connectivity

- Pre-Launch Pricing Structure and Token Mechanism

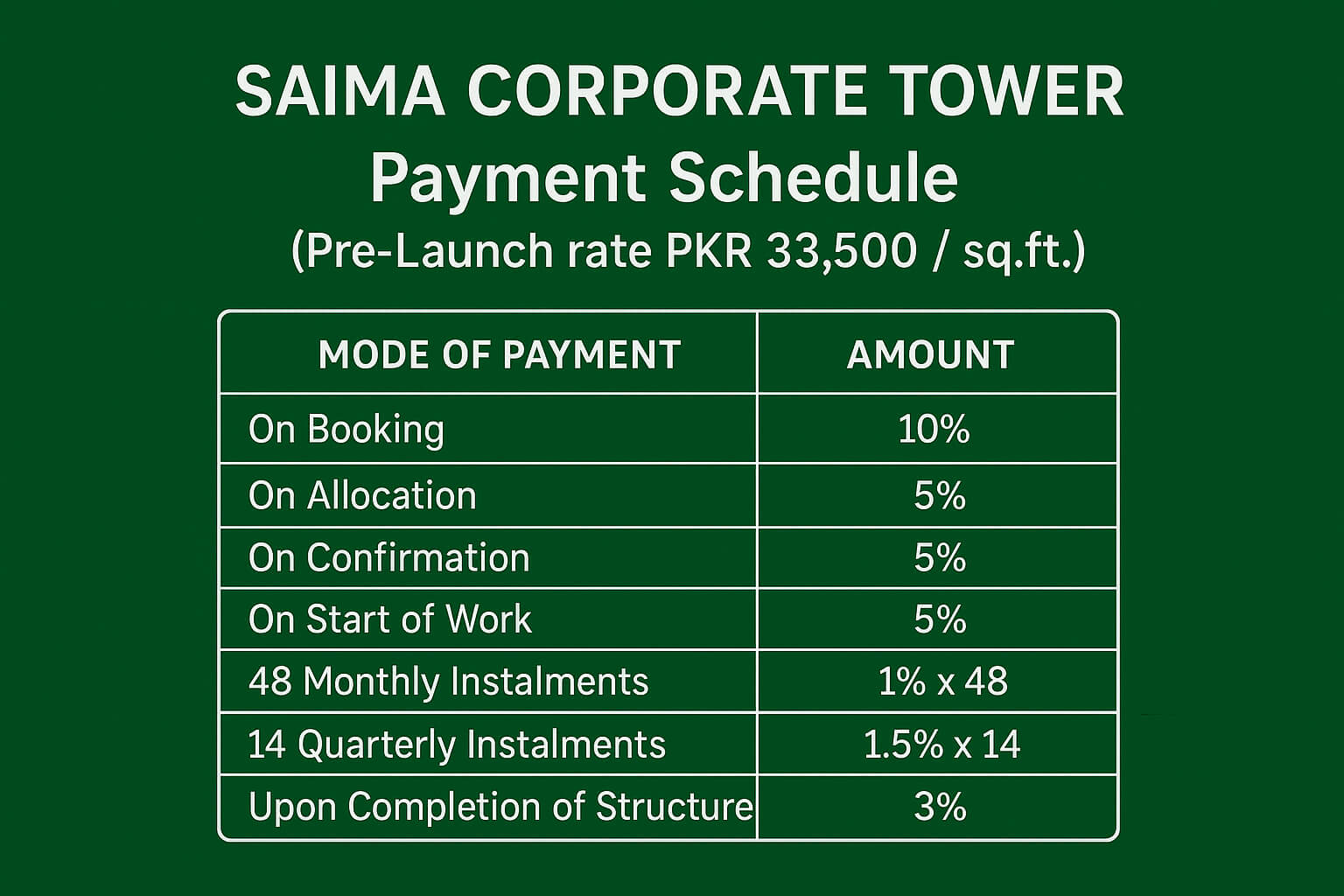

- Comprehensive Payment Schedule Breakdown

- Optional Façade and Positioning Premiums

- Comparative Payment Structure Positioning

- Project Amenities and Operational Infrastructure

- 2026 Investment Thesis and Rental Market Positioning

- Booking Process and Documentation Requirements

- Comparative Market Analysis: Alternative CBD Listings

- Contact Us

Saima Corporate Tower Payment Schedule represents a structured capital deployment opportunity in Karachi’s central business district, positioned for 2026 market entry. Located behind PIDC on PIDC Road in Civil Lines, opposite PC/Movenpick Hotel, this pre-launch offering provides corporate office units ranging from 950 to 2,100 square feet at PKR 33,500 per square foot—below anticipated launch pricing of PKR 38,000–40,000 per square foot. The payment framework balances initial capital outlay with milestone-aligned instalments across 48 monthly and 14 quarterly tranches, enabling institutional and individual investors to manage cash flow while securing premium office space in a high-demand corridor. As global commercial real estate markets navigate capital availability constraints in 2026, Karachi’s CBD office sector demonstrates sustained demand from multinational corporations and financial institutions seeking operational infrastructure and arterial connectivity.

Strategic Location and CBD Connectivity

Saima Corporate Tower occupies a position of significant urban connectivity within Karachi’s CBD. The property sits behind PIDC on PIDC Road, with direct proximity to Shahrah-e-Faisal and I.I. Chundrigar Road, facilitating rapid access to banking, government, and corporate hubs.

Opposite the CM House and PC/Movenpick Hotel, the address carries institutional credibility essential for multinational corporations, financial institutions, and professional service firms. This location positioning directly influences rental demand and capital appreciation potential, as corporate tenants prioritize accessibility, visibility, and proximity to regulatory and commercial anchors.

Pre-Launch Pricing Structure and Token Mechanism

The pre-launch rate of PKR 33,500 per square foot establishes an entry point before anticipated market rate adjustment. A token deposit of PKR 1,000,000 (applied against the 10% booking amount) secures unit allocation and floor preference.

For a 950 square foot unit, total acquisition cost is PKR 31,825,000; for a 2,100 square foot unit, PKR 70,350,000. The token mechanism reduces initial capital requirement while signaling serious buyer intent, reflecting developer confidence in market absorption and providing buyers with early-stage pricing advantage relative to post-launch rates.

Comprehensive Payment Schedule Breakdown

The payment schedule distributes financial obligation across eight distinct phases, aligned with construction milestones and regulatory requirements. The structure comprises the following components:

- Initial booking: 10% of total price (with PKR 1,000,000 token credited)

- Allocation phase: 5% upon unit allocation

- Confirmation phase: 5% upon file confirmation

- Start of work: 5% upon construction commencement

- Monthly instalments: 48 payments at 1% each (totaling 48%)

- Quarterly instalments: 14 payments at 1.5% each (totaling 21%)

- Structure completion: 3% upon building completion

- Possession: 3% upon handover

This phased approach aligns buyer payments with tangible construction progress and regulatory clearances, extending across approximately 4 years of active repayment post-booking.

Monthly and Quarterly Instalment Analysis

For a 950 square foot unit, monthly instalments total PKR 318,250 across 48 months, while quarterly instalments amount to PKR 477,375 across 14 quarters. For a 2,100 square foot unit, corresponding figures are PKR 703,500 monthly and PKR 1,055,250 quarterly.

The dual-instalment structure provides flexibility: buyers may prioritize monthly payments for cash flow management or concentrate capital in quarterly tranches. This bifurcated approach accommodates varying investor liquidity profiles and business cash cycles, particularly relevant for corporate entities with quarterly financial planning frameworks.

Optional Façade and Positioning Premiums

The project offers three optional premium configurations based on unit positioning and exposure. These premiums reflect market differentiation based on natural light exposure, corner visibility, and street-level prominence:

- Courtyard-facing units: 10% premium

- Corner units: 5% premium

- Road-facing units: 5% premium

For a 950 square foot base unit, these premiums translate to PKR 3,182,500, PKR 1,591,250, and PKR 1,591,250 respectively. For a 2,100 square foot unit, corresponding premiums are PKR 7,035,000, PKR 3,517,500, and PKR 3,517,500—factors directly correlated with rental command and tenant attraction in corporate office markets.

Comparative Payment Structure Positioning

The Saima Corporate Tower payment schedule employs a 100-month amortization window (48 months monthly plus 14 quarters), extending across approximately 3.5 years of active repayment post-booking. This extended timeline reduces monthly burden relative to conventional 24–36 month structures common in Karachi’s residential market.

The 48% allocation to monthly instalments versus 21% to quarterly instalments suggests developer prioritization of predictable cash flow during mid-construction phases. Compared to alternative CBD office projects, this structure balances early-stage capital intensity with mid-phase liquidity relief, making it accessible to mid-market corporate investors and smaller institutional buyers.

Project Amenities and Operational Infrastructure

Saima Corporate Tower incorporates institutional-grade amenities designed for premium tenant retention and operational efficiency. The development features infrastructure critical for multinational and financial sector tenants:

- 5-star lobby with professional reception

- Dedicated gym and pool facilities with sauna

- On-site food court for tenant convenience

- Conference hall infrastructure for corporate events

- 10 high-speed lifts reducing wait times

- Multi-level parking (Basement 1, Basement 2, dedicated floors)

- 300+ visitor parking spaces

- 24/7 security with integrated surveillance

- Backup power systems ensuring operational continuity

- Integrated fire safety protocols

These operational features address continuity and risk mitigation requirements essential for corporate office tenants.

2026 Investment Thesis and Rental Market Positioning

Saima Corporate Tower’s CBD location and institutional-grade infrastructure position it for sustained rental demand from multinational corporations, banking institutions, and professional service firms. Karachi’s corporate office market demonstrates consistent demand from entities requiring premium address credentials and operational infrastructure.

The pre-launch pricing of PKR 33,500 per square foot, positioned below anticipated launch rates, provides capital appreciation potential upon market rate adjustment. Rental yields in comparable CBD office properties typically range from 4–6% annually, though specific market comps should be verified through independent market analysis. The project’s proximity to regulatory hubs, hotels, and corporate anchors enhances tenant attraction and reduces vacancy risk relative to peripheral office developments.

Booking Process and Documentation Requirements

Securing a unit at Saima Corporate Tower requires submission of PKR 1,000,000 token via cheque (subject to clearance), followed by completion of 10% booking amount. MaxX Capitals facilitates site visits, brochure distribution, and legal documentation support throughout the acquisition process.

Initial booking floors include the 6th, 10th, and 14th levels, with floor selection subject to availability and booking sequence. Buyers should request the complete official payment schedule, floor plans, and architectural specifications prior to token submission. Legal due diligence, including verification of developer credentials, project approvals, and regulatory compliance, is recommended before financial commitment.

Developer Track Record: Saima Builders

The project is presented as Saima Corporate Center — Pre-Launch by Saima Builders, a developer with established presence in Karachi’s real estate sector. Saima Group has positioned itself on principles of quality, trust, authenticity, and durability in real estate planning and development.

Prospective investors should conduct independent due diligence on Saima Builders’ project delivery history, completion timelines, and post-handover support infrastructure. Developer track record directly influences project completion risk, possession timelines, and long-term asset management quality.

Comparative Market Analysis: Alternative CBD Listings

Karachi’s CBD office market includes several comparable pre-launch and ready-possession properties. Investors evaluating Saima Corporate Tower should conduct comparative analysis of competing CBD office developments, assessing location accessibility, amenity quality, payment flexibility, and developer track record.

MaxX Capitals maintains current market intelligence on comparable listings and can provide analytical positioning relative to alternative investment opportunities in Karachi’s commercial real estate sector. Independent market analysis should verify rental comps, vacancy rates, and tenant profile mix in competing properties to establish risk-adjusted return expectations.

Saima Corporate Tower Payment Schedule represents a structured entry point into Karachi’s premium CBD office market at pre-launch pricing. The phased payment framework—combining initial token deposit, milestone-aligned instalments, and extended amortization—accommodates diverse investor capital profiles while maintaining developer cash flow requirements. Strategic location behind PIDC, institutional-grade amenities, and anticipated market rate appreciation above current pre-launch pricing establish a compelling investment thesis for corporate office acquisition. Prospective buyers should request comprehensive documentation, conduct independent legal and market analysis, and engage MaxX Capitals for detailed site evaluation and payment schedule clarification to secure preferred floor allocation before launch rate adjustment.

Contact Us

Request the complete payment schedule, floor plans, and site visit details for Saima Corporate Tower. Contact MaxX Capitals today to secure your pre-launch office allocation at PKR 33,500/sq.ft. and receive a detailed 2026 investment analysis tailored to your capital deployment strategy.

Join The Discussion