HMR Waterfront DHA Phase 8 stands as a benchmark for waterfront residential investment in Karachi, combining direct Arabian Sea frontage with strategic accessibility. This 33.12-acre development in DHA Phase 8 Zone D along Abdul Sattar Edhi Avenue targets high-net-worth families prioritizing security, prestige, and long-term capital growth. MaxX Capitals’ analysis underscores its positioning within Karachi’s constrained supply of premium coastal properties.

Strategic Location and Market Positioning

HMR Waterfront DHA Phase 8 converges accessibility and exclusivity on Abdul Sattar Edhi Avenue. Key proximities include Dolmen Mall for retail, Clifton Beach for recreation, South City Hospital for healthcare, Karachi Grammar School for education, and Jinnah International Airport for connectivity. This ecosystem supports affluent lifestyles without compromising coastal tranquility.

Proximity to Institutional Anchors

Airport access minimizes travel friction for international professionals. Educational and healthcare facilities ensure family-centric support. Retail and leisure options enhance daily convenience.

Architectural Design and Residential Configuration

Units range from 1-bedroom (1,035 sq ft) to penthouses (8,101 sq ft), accommodating diverse needs. Open-plan layouts maximize sea views, natural light, and ventilation via private balconies. Finishes feature branded appliances, smart systems, and energy-efficient designs by firms like Nikken Sekkei.

World-Class Amenities and Lifestyle Infrastructure

Amenities create a resort-like environment:

- Infinity pool with sea views

- Gymnasium and fitness facilities

- Private beach access and promenade

- 24/7 security

- Landscaped gardens and trails

- Sauna, yoga spaces, kids’ areas

- Community halls, retail, mosque

Wellness features address preventive health, while gated security ensures safety.

Investment Fundamentals and Capital Appreciation Potential

Pricing spans PKR 4 crore (1-bed) to PKR 39.11 crore (penthouse), reflecting early positioning advantages. DHA waterfront scarcity drives 4-6% rental yields and 8-12% medium-term appreciation per MaxX Capitals modeling. NOC approval mitigates risks in Karachi’s appreciating market.

Flexible Payment Structures and Financial Accessibility

Plans include 20% booking and 3-year installments, aligned with construction milestones. Options reduce liquidity risks for diversified portfolios. Customized financing available via MaxX Capitals.

Family-Centric Community Design and Social Infrastructure

Green spaces and trails foster intergenerational interaction. Proximity to schools and healthcare supports multigenerational needs. Community events enhance social cohesion beyond unit luxury.

Regulatory Certainty and Developer Credibility

HMR Group’s track record across Pakistan and UAE ensures compliance and delivery. NOC status provides execution confidence. Established developers in DHA Phase 8 command pricing premiums.

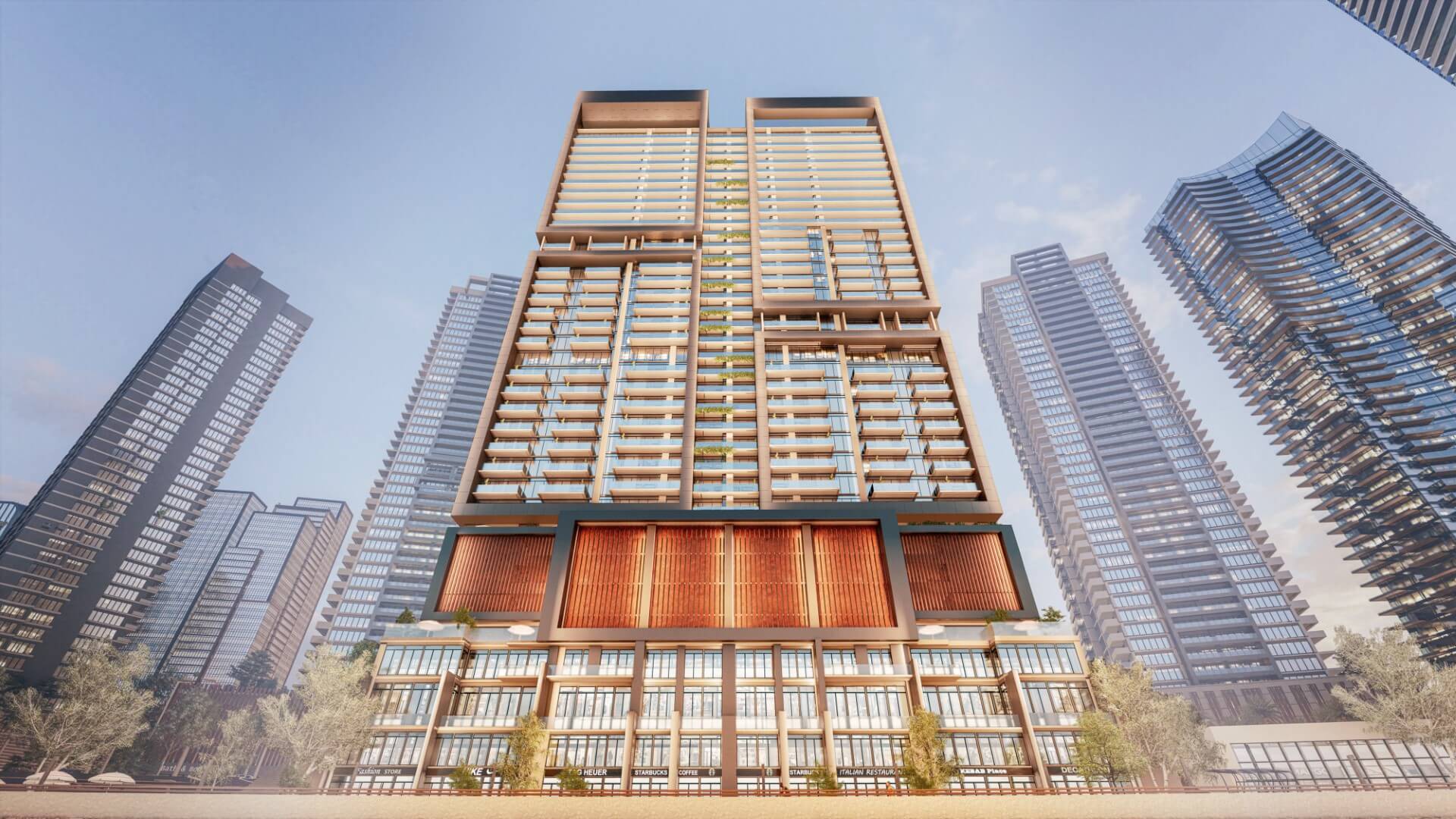

Architectural Excellence and Design Innovation

Passive strategies optimize ventilation and efficiency. H1 Tower’s 39 stories maximize sea exposure and unit privacy. Smart integration meets affluent technological standards.

Other Notable Listings in HMR Waterfront DHA Phase 8

HMR Waterfront DHA Phase 8 Karachi – Sea-Facing Luxury Apartments & Penthouses (Property ID: 19876): Entry at PKR 4 crore for 1,035 sq ft, ideal for initial luxury positioning with full amenities. HMR Waterfront Karachi | Luxury Apartments in DHA Phase 8 (Property ID: 23628): PKR 42.5 crore for 907 sq ft, suited for compact executive use with optimized pricing.

Waterfront Living and Lifestyle Context

Access to Do Darya dining and Clifton retail integrates urban vitality with serenity. For Emaar Oceanfront vs HMR Waterfront Karachi: Strategic Investment Comparison, review Emaar Oceanfront vs HMR Waterfront Karachi: Strategic Investment Comparison. DHA Phase 8’s ecosystem balances convenience and exclusivity.

HMR Waterfront DHA Phase 8 offers regulatory-backed waterfront positioning with architectural rigor and lifestyle integration. MaxX Capitals’ data confirms its role in diversified portfolios amid DHA’s premium dynamics. Investors benefit from scarcity-driven value persistence.

Contact Us

Contact MaxX Capitals at +92 333 2110529 or info@maxx.pk for unit analysis and customized modeling.

Join The Discussion